Apr 22, 2024

Prop Firm Trading: What No One Tells You

In episode 451 of the Desire To Trade Podcast, we will be listening to the recording of an interview with expert trader, author, and mentor, Steve Miley sharing what no one tells you about prop firm trading. Find out the potential future of prop firms and the possibility of...

Apr 15, 2024

Become A More Aggressive Trader

In episode 450 of the Desire To Trade Podcast, you will learn how to become a more aggressive trader, defeat self-doubt, and deal with the fear of loss. It's time to take control and not let panic get the best of your trading!

Forex Trader Motivation playlist

>> Watch the...

Apr 8, 2024

Secrets Of Day Trading For A Living

In episode 449 of the Desire To Trade Podcast, we will be listening to the recording of an interview with Andrew Aziz talking about the secrets of day trading for a living. Learn the importance of a disciplined mindset, sticking to what you know, and developing good habits as a...

Apr 1, 2024

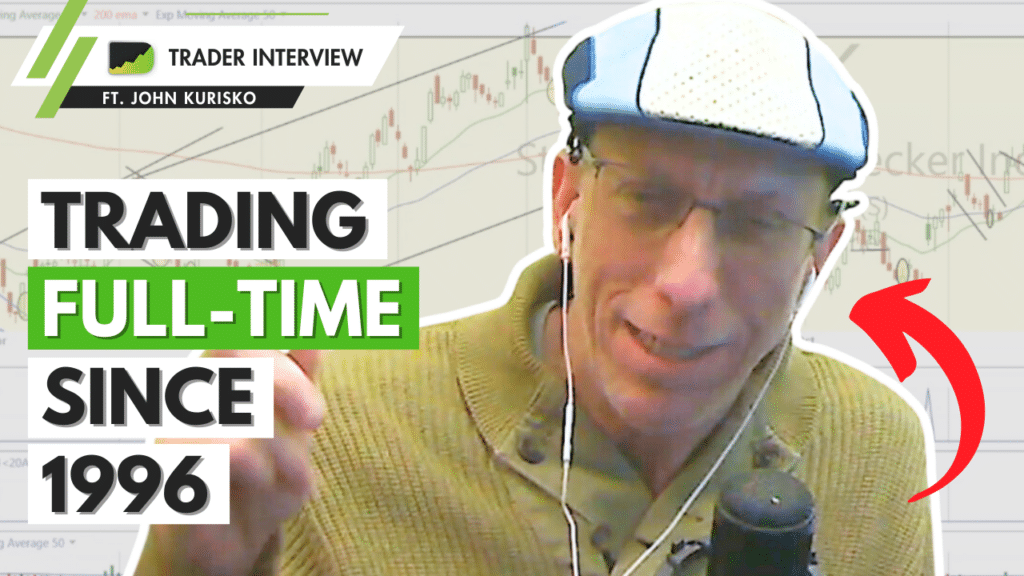

The Scalping Strategy To Make A Living Trading

In episode 448 of the Desire To Trade Podcast, we will be listening to the recording of an interview with John Kurisko of Day Trading Radio, talking about the scalping strategy to make a living trading. Why is patience and discipline so important for traders?

The video is...

Mar 25, 2024

Success Story Of A Profitable Trader

In episode 447 of the Desire To Trade Podcast, we will be listening to the recording of an interview with full-time trader, Denis Switalski, sharing the success story of a profitable trader. Trading strategies aren't one-size-fits-all. This interview can help you discover what...